On 18 December 2019, the Government gave 250,000 (that’s a quarter of a million) workers notice that they would be getting a pay rise on 1 April 2020. If you are a SME employer, you may have quietly ignored that news until the new year. Sorry you can’t ignore it any longer.

1 April is effectively just over 1 month away, and we know many SMEs are in planning and budgeting mode for the new financial year. After attending a Strategic Pay remuneration briefing late last year, we know that many employers haven’t shifted far away from the standard 3% increase on their wages/salaries budget. Strategic Pay surveyed 1331 organisations in 2019 and reported that projected payroll increase for the general market in 2019/2020 is 3.0%*. This has been fairly consistent since I started going to these briefings in 2013 or 2014. Post GFC, in 2009-2010, the projected payroll increase was 2.3%, so there has been a marked increase over the decade*.

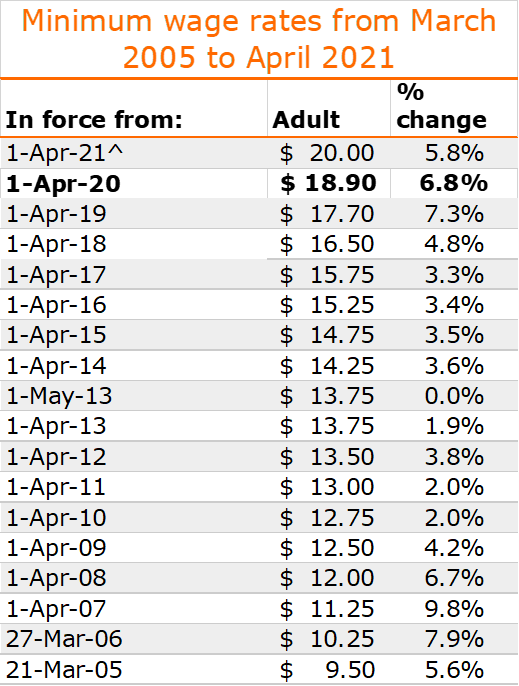

Here are some interesting numbers for you to consider and pass on to your accountant for consideration. In 2019 the minimum wage went from $16.50 per hour to $17.70 per hour. That is a 7.3% increase. Then when it increases again to $18.90 per hour on 1 April 2020, that will be a further 6.8%. That’s 14.1% in two years.

We understand that not all employees are paid minimum wage in a business, but hang on what do these sorts of increases mean for the rest of your workforce?

Are they getting a good deal from you? Or is it time for them to look elsewhere? Did you know that employees will be get bigger pay increases by moving roles than staying in them?

We all know that people don’t stay in a job or with an employer for money alone. Its culture, sense of achievement and the people they work with. But there does come a point where they question the value they are receiving from the employer compared with the environment and other rewards they are getting. A common example is if changes in the business have resulted in more workload and stress but the value and appreciation they receive hasn’t changed or declines, then they may start looking elsewhere. My husband, the economics teacher, could say this is an example of the law of diminishing marginal utility.

Oh, and just in case you are worried now. The press release in December 2019 explains that the government intends to further increase the minimum wage to $20 per hour in 2021. Is this in your 2021 budget?

Now don’t get me wrong there are some employees out there that need these increases for a variety of reasons. What we are most concerned about is the flow on affects these wage increases have on SMEs who employ many of our middle-income earners, operate with tight budgets, and struggle to attract good talent. Also let’s not forget that wages/salaries will most likely be the largest expense item on the financial performance statement.

So you know you have a problem with how much you pay. But you don’t know where to start or there are too many things to fix?

Firstly, look at the rates you pay your high performing employees. Are they fair for the work they do and the value they add to your business? To determine the answers to this you need to do some research. We can help with this because relying on what you have always known may not necessarily still be true today. Maybe it is time to review your pay structure for your high performers. Heard of profit-sharing instead of commission or bonus’?

Next you need to look at what you pay those who are not performing compared with your expectations, or are they creating barriers to your business performance. Are there some issues there you have been avoiding or sweeping under the carpet?

Another aspect to consider is, are the benefits you are offering to your team, that you haven’t communicated the value of to your team. For example – commuting use of a company vehicle should have a value attached, as should professional registration fees, or an employee’s internet at home because they work from home.

Finally look at your productivity. Rather than just slashing items on your budget and cutting back on pay reviews, you must ask yourself, can things be done smarter, quicker and more efficiently? Do we need to change the way we work? How can technology help us? NZ rates poorly against the rest of the world when it comes to productivity. You could consider this when reviewing your substandard performers too. Maybe it is not the person but the process and the systems? Or you could have someone in the wrong job?

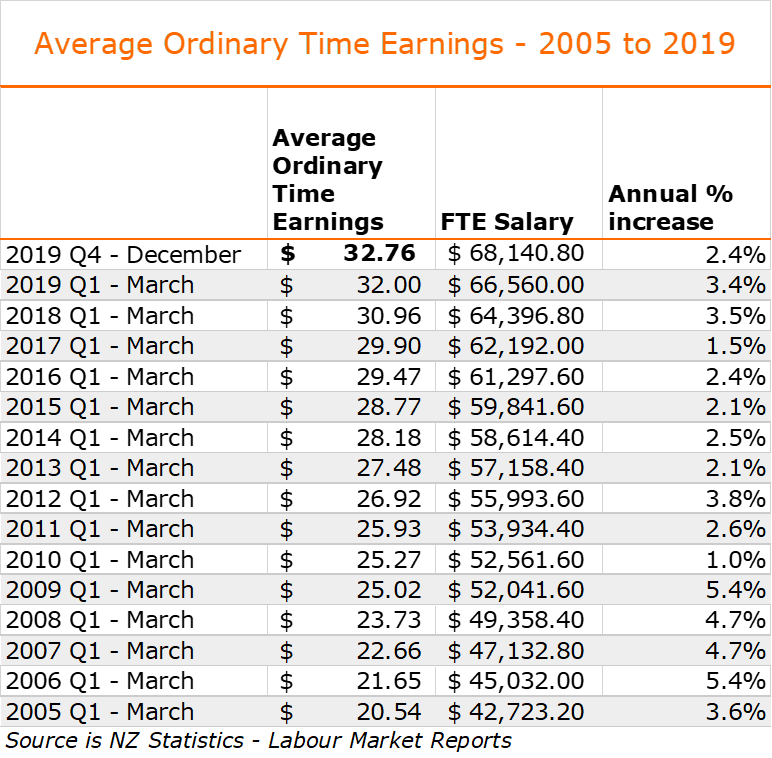

Many look to CPI as an indication for pay increases. Statistics NZ produce a quarterly labour market report. This is a user-friendly summary of what is happening on a quarterly basis. It includes information about wage inflation rates and changes to the average ordinary time earnings. These are important labour force indicators for SMEs to consider along with CPI. Now more so than ever. Given many SMEs have employees in positions that are at or around the average salary, these are figures you should review each year. Recent union negotiations and settlements are only just starting to an impact on these figures.

To give you an idea of what has been happening to employee pay in the previous 15 years, below is a table of the changes to the minimum wage and average ordinary time earnings

Adult Minimum Wage 2020 to 2005

^ this is the figure reported in the government press release referred to earlier in this article. Source – employment.govt.nz

Changes to Average Ordinary Time Earnings – 2005 to 2019

As you can see from the tables above, the minimum wage and average ordinary time earnings (OTE) don’t increase in proportion with one another. The second table reporting on average earnings shows just how quickly an annual salary can increase with small annual increases of between 1 -3%. In 5 years, the average salary has increased by almost $10,000 per year.

If you haven’t done a pay review for your team in the last 2-3 years, then now is the time. If you have financial constraints, then let’s look at other ways of valuing your team. There is a talent shortage out there and many employers headhunting for great talent. We are about helping you to retain great talent and attract people who want to work for your business, so you can see the forest for the trees.

Got questions? We’ve got answers! Give us a call today.

* source – Strategic Pay Remuneration Briefing slides November 2019