minimum wage increase: What does it mean and how to plan for it

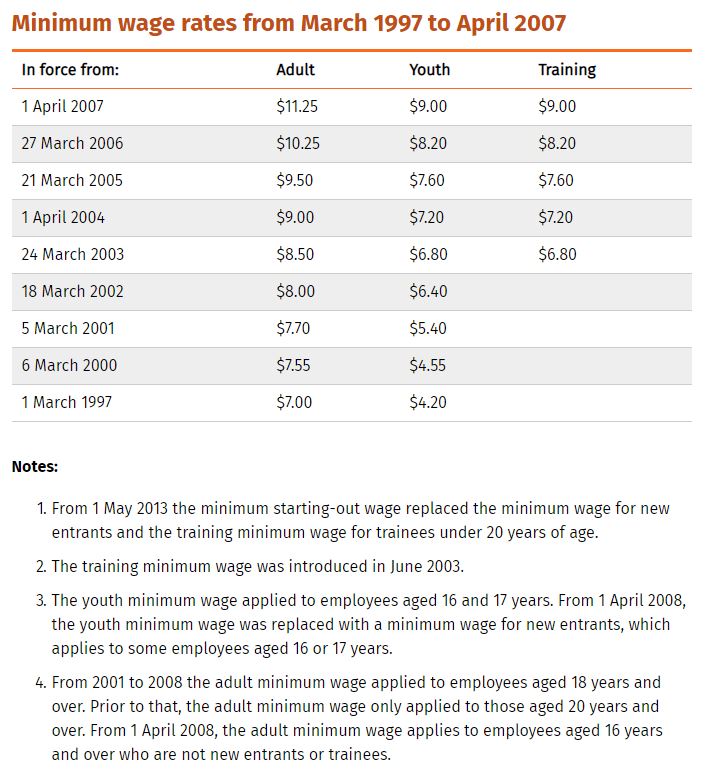

As at 1 April 2019, the minimum wage increases to $17.70 per hour. That equates to $708 for a 40-hour week.

This is the largest increase to the minimum wage. The last time we saw a similar increase was in 2007, when it increased by $1.00 per hour, from $10.25 to $11.25 per hour.

The minimum has steadily increased over the years. On 1 April 2009 the minimum wage was $12.50. That is an average increase of 0.48c per year since. The government has also signalled that they would like the minimum wage to increase a further $2.30 per hour by 2021 – $18.90 from 1 April 2020 and to $20 from 1 April 2021. These are still subject to the annual review and not confirmed.

However, with increases like these, you need a plan and a budget.

We appreciate why Government would like to get the minimum wage higher. The cost of living has steadily increased while wages have lagged. There are arguments why wages should not be linked to CPI and some for why there is a direct link. We will leave it up to the economists to argue over those details.

What we know is, these minimum wage increases are forcing employers to reconsider what they view as a fair pay for a fair day’s work.

If you haven’t reviewed your employees pay for over 2 years, then I am guessing you have some catching up to do. Especially if the work these employee’s do, is work you can’t charge for and any pay increase will only eat away at your margins.

The feedback from clients on why they haven’t done any pay review is usually:

We don’t want to increase our prices.

We don’t have the time to do reviews and deal with the negotiations.

There won’t be any money left over to reinvest or we can’t afford it.

We think they are already getting paid fairly for the work they do.

The trouble is, if you don’t do annual reviews, or in some cases six-monthly reviews, you may find that you have a lot of catching up to do.

Minimum wage has increased an average of 3.4% every year since 2013. Have you increased all your employee’s pay by that in the previous 5 years?

How to plan for your pay reviews

First things first, figure out your real staff costs. That includes mobile phones, vehicles, ACC, Kiwisaver, extra leave and uniforms etc. Get into the detail with your accountant or business advisor to figure where are you now. This is your current state.

The next step is to figure out your future state. Do your research and find out what others are paying for the same or similar skills. This include financial and non-financial benefits. What is everyone else offering?

When you do this exercise, you could either find your jaw gaping open or instead are quietly happy with yourself. Either way, you should be doing this exercise every year as part of your business planning and forecasting.

Good employees are being headhunted and offered an array of benefits and extras to entice them away.

Recently, an employer reported that a new employee had been contacted within the first 3 months and was being offer profit sharing incentives. You really have to know your competition if you are going to keep your good people.

Set the minimum and maximum you will pay for the work – not the person

When you know what everyone else is paying and offering on top of salary or wages, set yourself some rough parameters, what is the highest you can pay and the lowest you think you could get away with.

Consider the value of the work and the skills, competency, expertise and training etc required to do the work. Also, when the job is done well what value can that return to the business.

Only think about the job and not the people you have now.

Having this firmed up in your mind will prepare you for the Friday afternoon employee chat that results in them asking for a pay increase because Dave down the road is offering $5 more per hour. In this situation, you will know exactly how much more you can offer without compromising, and explaining why you pay them the amount you do.

If you know you offer very good non-financial benefits, like a top-notch coffee machine, purchasing perks, gym memberships and flexible time or working from home days, then you may choose to pay a little less salary or wages. Your culture and employer value proposition come into play here.

What do your employee’s value and how would you like to add more value into their employment experience without it costing you an arm and a leg?

The answers to these questions will form part of the principles you rely to inform your pay-related decisions.

You should consult with your employees on these. It will help them understand your reasoning when making pay related decisions. You will also come to realise what they value most from you.

Once you are armed with information about your existing costs, are clear on the principles relating to pay and what other businesses are paying for the employee skills, it’s time to find out how much catching up you may need to do. What is the true gap for each employee?

Map out the gap for each employee using:

- Base Salary: The cash your employee receives in the bank account.

- Fixed Remuneration: The cash and the benefits that have a fixed value (e.g. tools allowance or vehicle allowance).

- Total Employee Cost: All-inclusive. The budget you put to any variable pay components, ACC and the extras you buy for them being an employee.

Then play around with the numbers to figure out what you can offer based on your budget.

Hint: If you have a lot of catching up to do with some employees, look at a transition plan over a couple of years so you can manage the affordability of the increase better.

Where does employee performance come into pay reviews?

An employee’s remuneration package reflects the value you place on the employee’s skills, expertise and capability. Inherent in this is their ability to perform the work you assign them.

Pay and performance can be linked but it doesn’t have to be. You could have a policy that says all staff get a flat 2% increase irrespective of performance. This is how the Unions operate.

It’s natural for you to think: “I don’t want to pay them that much because they don’t perform”.

This is no different to when you are faced with the choice to buy an ineffective product for a high price, or an effective product at an affordable and reasonable price. But what do you perceive as affordable and reasonable? Do your research and some navel gazing to answer this question as it is differs depending on the industry and business, and the views you and your employees have.

Nonetheless, if you want to be able to factor performance into any of your pay reviews, you must be setting performance expectations and defining what good performance is – before you start measuring and making judgements on it.

Only when you have done this can you put a price range on what ‘good performance’ is worth to your business. If that ‘job’, when done well, has a significant impact on your business and bottom line, then that should be factored into the pay range on offer for the skills and expertise required.

It is then up to the person to demonstrate their value to you when they perform the work. For the Employers losing access to the trial period provision, your recruitment, induction and performance management processes may need attention to ensure you are not paying more than you are getting from employees.

Staff costs are usually the largest cost centre for businesses, so your employees pay and performance deserves your time and attention. Having a good plan and reviewing staff costs at least annually will ensure you stay ahead of what everyone else is doing, as well as ensure your business stays profitable and continues to attract great people.

If you are struggling to keep good people because of the pay you offer, just remember, pay usually becomes a problem for an employee after other needs are not being met.

2019 is the year for taking a step back to review and consolidate what you do. Check in with us if you need help with your remuneration and performance reviews.

Stapleton Consulting where employers come to see the forest for the trees.

Minimum wage table: 1997 – 2019

Source: Employment NZ